January 13, 2025

Solar Industry 2025

The world is undergoing an energy transition to safeguard itself from nature's fury. It is switching towards renewable energy sources, and solar energy stands out as a promising choice among the non-conventional options.

Solar panels convert sunlight into electricity. Their key advantages are scalability and simplicity, as solar installations do not require complex infrastructure setups. However, solar projects have high initial costs, which financial institutions typically cover through loans.

Therefore, the interest rates levied on these loans significantly influence both sellers and buyers. Wondering how interest rates will impact the solar industry in 2025? Here, this blog will give you a sneak peek into it. Stay tuned to stay informed!

Key Takeaways

Following are the key takeaways from the blog:

- Interest rates greatly influence the solar industry, as solar companies and consumers rely on loans from financial institutions.

- The Federal Reserve's interest rate cuts are expected to support solar energy storage and development.

- The reduction in interest is projected to boost solar capacity in 2025 by increasing demand for solar projects.

- The Solar Energy Industries Association (SEIA) reported a significant decline in residential solar installations, though a recovery is anticipated due to the interest rate cuts.

- With technological advancements, government assistance, and cost-effective loans, solar cells are poised to become more energy-efficient, leading to a thriving future for solar energy.

Worth reading: Best Solar Practices for Residential Projects in Canada

The Interplay of Interest Rates and Solar Installations

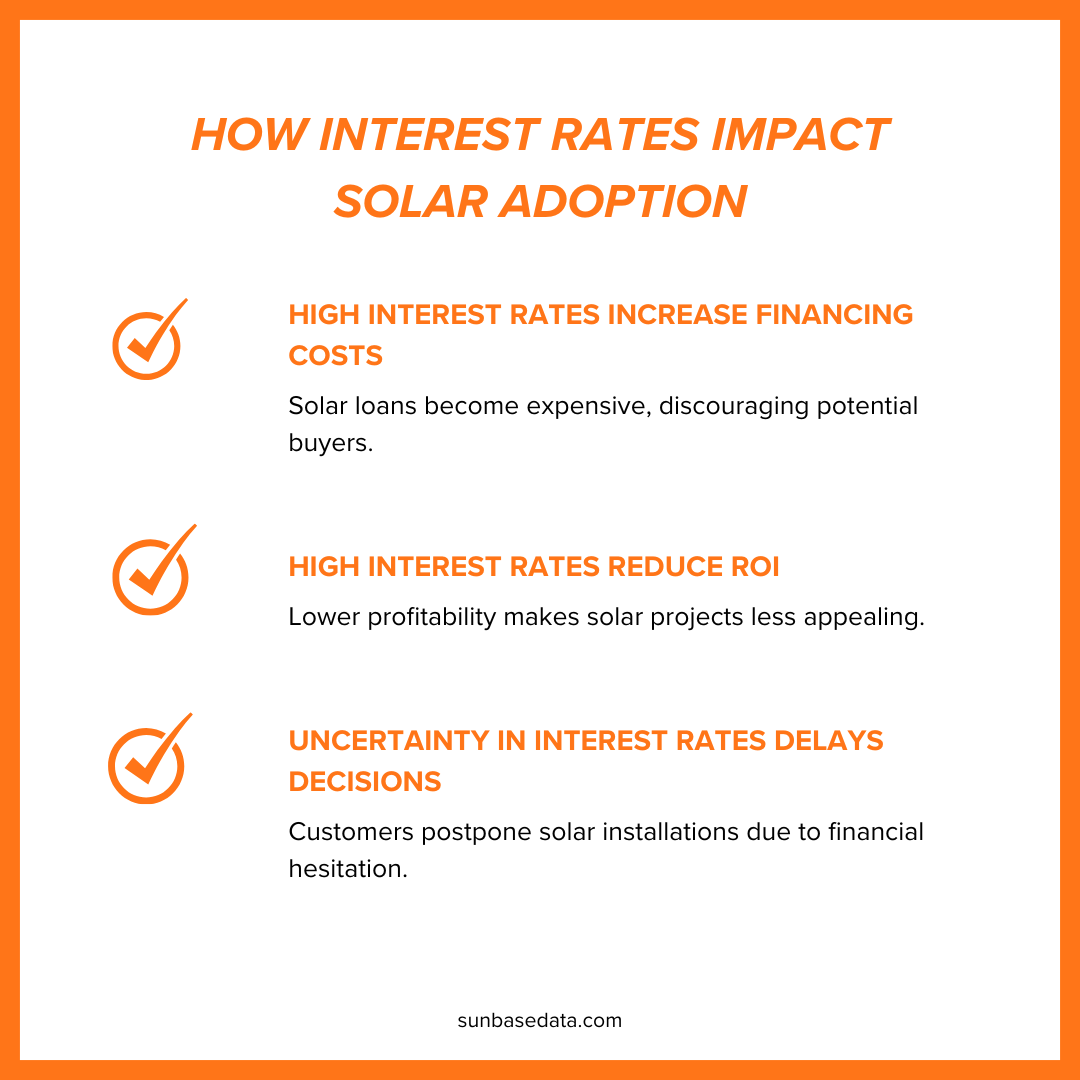

The interest rates and solar installations are closely related because solar projects depend on funding to cover the initial costs. Here is how they are connected:

1. Financing Costs:

High interest rates increase the cost of borrowing money, making the loans required for solar installations even more expensive. This can discourage buyers from adopting solar power projects.

2. Return on Investment:

Solar projects are often evaluated based on their Return on Investment (ROI) over their lifespan.

However, high interest rates can negatively impact the ROI, making solar projects less lucrative for consumers.

3. Decision Making:

Interest rates also have a psychological effect on potential customers. Uncertainty about interest rates can lead to delayed decision-making, which in turn might postpone solar initiatives.

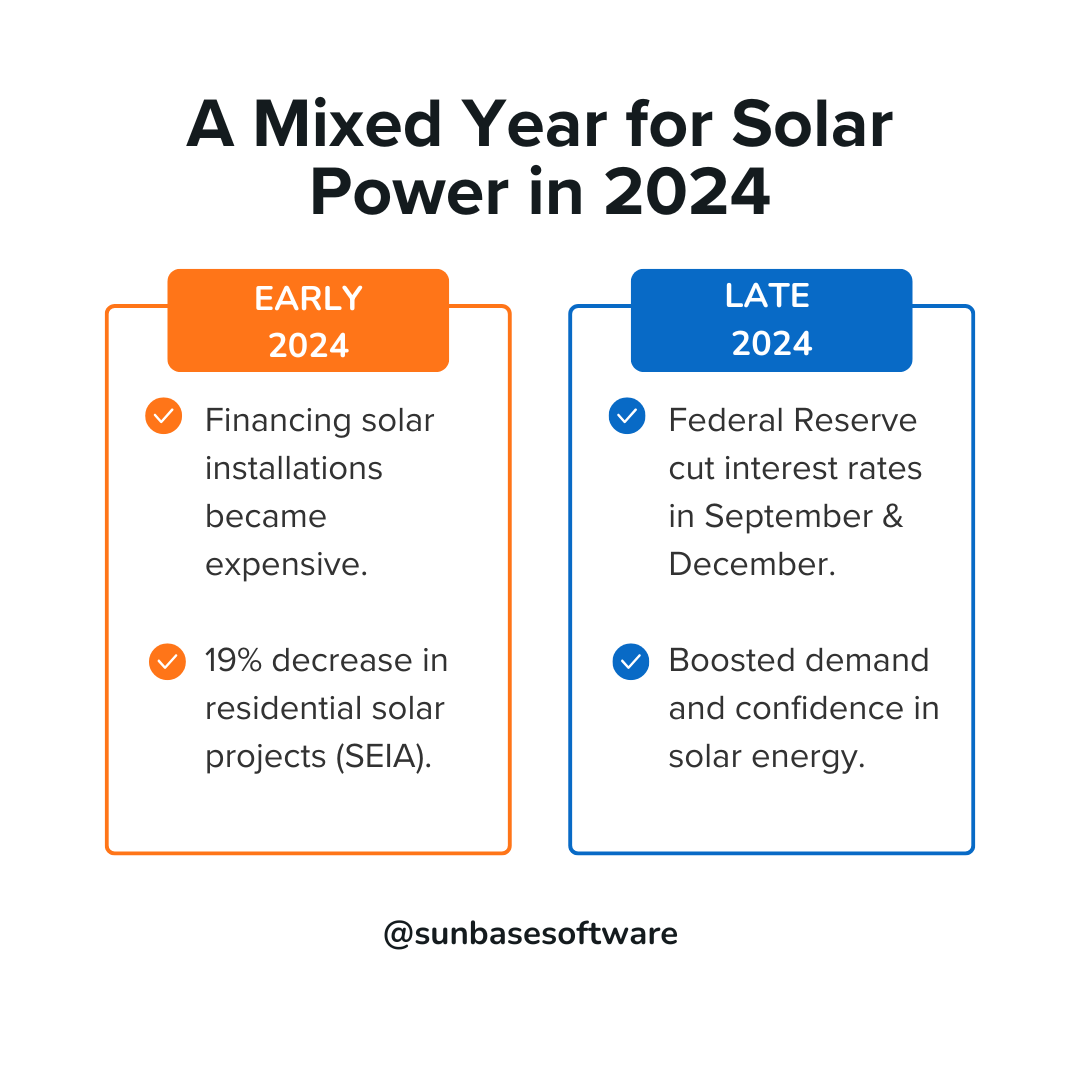

A Mixed Year for the Solar Power in 2024

Look at the detailed analysis:

Early 2024 Interest Rate Landscape

At the beginning of 2024, there were consistently high interest rates. They posed challenges for the residential solar market. Many homeowners found it expensive to finance solar installations, as a consequence, the demand in the market decreased. The solar companies that relied on traditional financing methods also struggled a lot.

According to the Solar Energy Industries Association (SEIA), residential solar projects decreased by 19% in 2024.

Late 2024 Interest Rate Picture

In September and December 2024, the Federal Reserve implemented significant cuts to interest rates. These cuts were applied to reduce hesitation in adopting solar energy and stimulating market demand.

Must read: Emerging Trends in Solar Energy: A Global Perspective

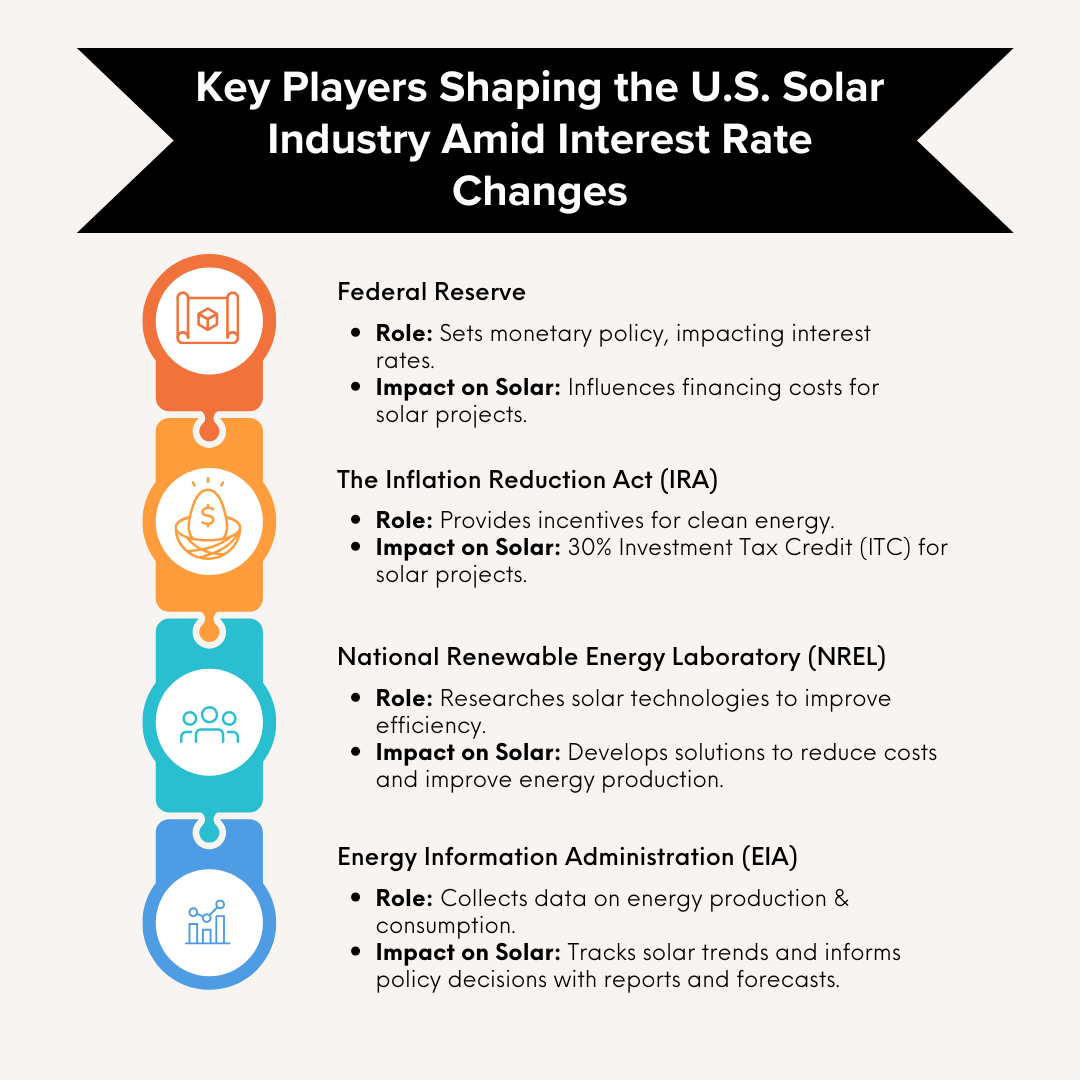

Key Players Managing the Interplay Between Interest Rates and Solar Industry in the U.S.A.

These entities play a crucial role in navigating the dynamics between interest rates and the growth of solar energy in the U.S.A. Here is an overview of how these entities work to promote solar energy.

1. Federal Reserve

The monetary policy of the Federal Reserve directly impacts the interest rates, which further influences the financing costs for solar energy projects.

2. The Inflation Reduction Act (IRA)

Inflation Reduction Act (IRA) provides substantial investment to combat climate change and support renewable energy projects. It offers rebates and tax credits to encourage clean energy usage. It is aimed at lowering upfront costs for homeowners and businesses.

The act provides a 30% Investment Tax Credit (ITC) for solar projects. Additional incentives are also available for projects that meet specific criteria.

3. National Renewable Energy Laboratory (NREL)

The National Renewable Energy Laboratory (NREL) is conducting extensive research on solar technologies aiming to improve energy efficiency and reduce costs. They are focused on developing innovative solutions to make solar power more cost-effective. The NREL is actively trying to achieve a carbon-free electric grid in the United States.

4. Energy Information Administration (EIA)

EIA collects data and disseminates information on energy production and consumption, including solar energy. The reports prepared by EIA help track the impact of interest rates on solar panel installations and provide forecasts that inform policymakers and businesses about future trends.

The Impact of Interest Rates on the Solar Industry 2025

Here is an overview of how interest rate changes are shaping the solar landscape:

Rate Cuts by The Federal Reserve:

In September and December 2024, the Federal Reserve reduced the benchmark interest rate by a total of 75 basis points. A significant cut was implemented in December when the interest rate was brought between 4.25% and 4.5%. Further reductions are anticipated in 2025.

Look below, how the reduced interest rate is influencing the solar market:

1. Lower Financing Cost:

Relatively low interest rates reduce the cost of borrowing money for solar projects. Solar manufacturing costs investors less, as such ventures typically require significant upfront investment before becoming profitable.

2. Increased Affordability and Demand:

Lower interest rates make solar projects more affordable for homeowners and businesses, increasing the demand for solar plants.

3. Competitive Loan Options:

The interest rate cuts make loan offerings more competitive. Financial institutions like the Clean Energy Credit Union adjust their loan structures to attract consumers willing to invest in solar energy projects.

4. Enhance Project Viability:

Decreased interest rates lower the overall cost of solar projects, which positively impacts the Return on Investment (ROI). This increases the economic viability of solar systems, particularly for large projects.

5. Boosted Investor Confidence:

Due to low interest rates, the capital cost also lowers. This enhances the confidence of investors. They feel more secure while funding solar projects. Lower capital costs also enable them to experiment with new solar initiatives.

Do Check out: Solar Software for Everyone: Scalable Solutions for Big and Small Projects

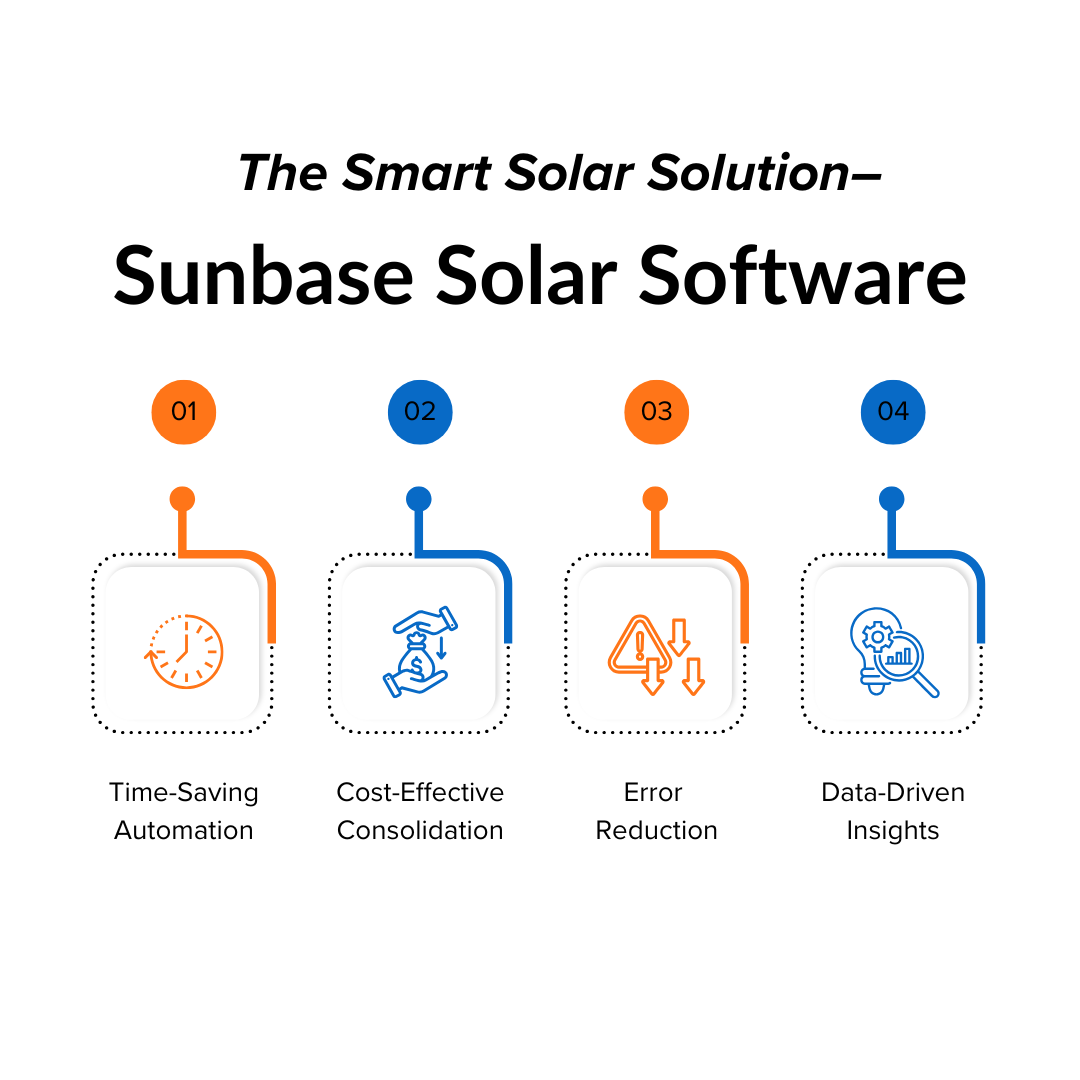

The Smart Solar Solution: Sunbase Solar Software

Let's explore the features of Sunbase Solar Software that make it a budget-friendly choice:

- Sunbase Solar Software is a cost-effective solution for solar industry businesses. It automates time-consuming tasks such as solar design creation, proposal generation, and follow-up reminders. This saves valuable team members' time and enhances their efficiency, enabling them to perform better in other tasks.

- It minimizes overhead operational costs by consolidating multiple functions into one platform, reducing or eliminating the need for separate digital tools.

- The software also significantly reduces the probability of human errors, which can result in expensive rework or fines.

- It provides data-driven insights that help solar companies to implement cost-saving measures.

Highly recommended: How Sunbase Helps Streamline Solar Proposals for Faster Conversions

Conclusion

The solar industry is significantly impacted by the shifting dynamics of interest rates. High interest rates reduce demand for solar panels in the market and discourage both solar developers and consumers.

On the other hand, low interest rates stimulate demand for solar installations. In such a case, residential and commercial solar projects become more accessible and affordable.

Despite the opportunities offered by low interest rates, challenges such as energy price inflation may still pose obstacles to the growth of the solar industry. However, these challenges can be mitigated with the help of thoughtful initiatives like the Inflation Reduction Act (IRA) that ensures significant investment to support renewable energy projects.

Hence, the key to overcoming these obstacles lies in strategic planning, investment in scalable technologies, and leveraging smart solutions like Sunbase Solar Software. The Sunbase Solar

Software streamlines and optimizes the operations in the solar industry while being cost-efficient.

Therefore, with improving financing options and advancements in technology, the future of solar energy in the power sector is bright.

Know More About Sunbase

Let solar power account for a major share of your success. Unlock the full potential of solar energy with Sunbase Solar Software.

Are you ready to boost your ROI and simplify your operations? Contact us today to ensure a sustainable and profitable tomorrow!

FAQs

Q1. What will solar panels look like in 2025?

With ongoing advancements, very high energy-efficiency solar panels are expected to emerge in 2025.

Q2. How will Electrical Vehicles (EVs) be integrated with solar power in 2025?

Clean energy sourced from solar panels is expected to meet the electricity demand for charging stations in 2025.

I agree to receive marketing messaging from Sunbase at the phone number provided above. I understand data rates will apply, and can reply STOP to OPT OUT.