March 19, 2024

Ever wondered how some businesses seem to effortlessly navigate the complexities of finance while others struggle to stay afloat? The answer lies in the not-so-secret weapon: financial management software.

With the advent of modern financial management systems, businesses can streamline their financial processes and fuel growth like never before.

Strap in as we uncover the transformative potential of this technological marvel and discover how it's reshaping the landscape of business as we know it.

What is a Financial Management System?

A Financial Management System, often referred to as FMS, is like the brain of a business's financial operations. It's a specialized software that helps organizations manage their money matters efficiently. From keeping track of income and expenses to creating budgets and generating reports, an FMS handles it all.

Think of it as a virtual financial assistant that simplifies tasks like invoicing, payroll, and reconciling bank accounts. An FMS centralizes operational data and automates repetitive tasks to save time and reduce errors. In a nutshell, it gives your businesses the clarity and control they need to thrive.

Financial management software—reports and analytics

Financial management software plays a crucial role in modern businesses as it provides essential tools for managing finances, unlocking insights, and facilitating informed decision-making. One of the key features of such software is its ability to generate comprehensive reports and analytics. Here's how financial management software helps in unlocking insights through reports and analytics:

1. Customization:

Many financial management software solutions offer customization options for reports, allowing businesses to tailor reports to their specific needs. Customization may include choosing specific data points, adjusting periods, and formatting reports according to the organization's preferences.

2. Performance Metrics:

Financial management software provides various performance metrics and key performance indicators (KPIs) that help businesses evaluate their financial performance. These metrics may include profitability ratios, liquidity ratios, efficiency ratios, and more. Analyzing these metrics through reports helps in identifying areas of improvement and making data-driven decisions.

Nowadays, organizations seek an effective financial management system that can drive profit, efficiency, and informed decision-making. As a result, the demand for reporting tools has grown significantly.

So, If you're looking for the best way to streamline your accounting, you must visit Sunbase FMS!

3. Visualization Tools:

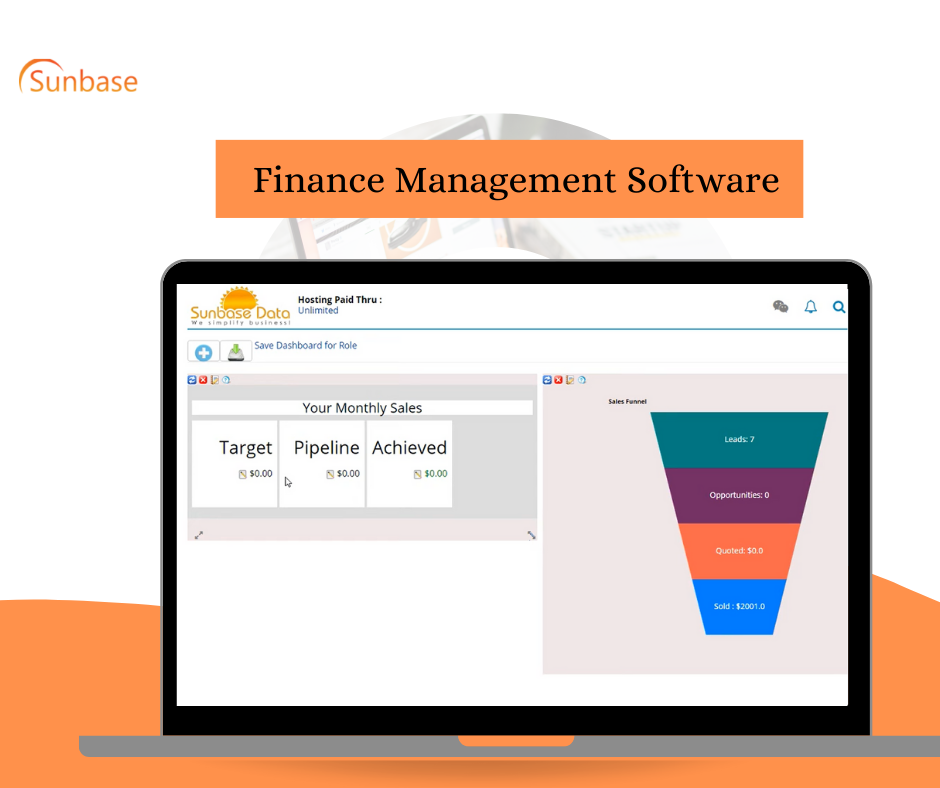

Many financial management software solutions offer visualization tools such as charts, graphs, and dashboards to present financial data in a visually appealing and easy-to-understand format. Visualization tools enhance the readability of reports and make it easier for stakeholders to identify trends, patterns, and outliers.

4. Compliance and Auditing:

Financial management software helps businesses ensure compliance with regulatory requirements and facilitates auditing processes. Reports generated by the software provide transparent documentation of financial transactions and activities, which is essential for regulatory compliance and audits.

5. Real-time Data:

With advanced financial tools like Sunbase or Zoho Finance, businesses can access real-time financial data, enabling them to make timely decisions. Real-time reporting ensures that managers have access to the most up-to-date information, which is crucial for strategic planning and managing financial risks.

To effectively manage financial data and provide real-time data, a good financial management system should possess key features. What exactly are these features and how do they help the businesses to grow? Let's discuss that!

How the Features of FMS Help Your Business?

Financial management software helps businesses track finances, and manage invoices, payments, and data. The software can also be used to generate reports and analytics. Modern Financial management systems can be a valuable tool for any business.

The features of an FMS can vary depending on the specific software you use. However, many of these features are standard across most financial management software programs.

1. Budgeting and Forecasting

A good financial management system should include budgeting and forecasting capabilities to help you plan for future expenses and income. This feature allows you to set budgets, track spending, and forecast potential profits based on your data.

2. Accounts Payable/Receivable

The FMS should be able to manage and track your accounts payable and receivable, including creating invoices, tracking payments, and managing cash flow.

3. Financial Reporting

As mentioned earlier, financial reporting is a critical aspect of any FMS. Look for software that provides detailed financial reports such as income statements, balance sheets, and cash flow statements to help you analyze your company's financial health.

4. Tax Management

Tax management capabilities are essential for any business. A good FMS should be able to assist with tax calculations, deductions, and preparation of financial data for tax filing.

5. Enhanced Visibility and Control:

FMS offers real-time visibility into financial transactions, budgets, and performance metrics. This transparency allows businesses to monitor their finances closely, identify areas of concern, and take proactive measures to address issues.

Additionally, features like compliance controls and audit trails provide greater control over financial processes, reducing the risk of fraud and non-compliance.

6. Optimized Resource Allocation:

With budgeting and forecasting capabilities, FMS helps businesses allocate resources effectively and plan for future expenses.

As the finance management tool helps your finance team to set and monitor budgets, you can identify areas of your business where costs can be reduced or reallocated to maximize efficiency and profitability.

7. Compliance and Risk Management:

FMS ensures compliance with regulatory requirements and internal policies by enforcing financial controls and audit trails. This helps businesses mitigate financial risks, avoid penalties, and maintain their reputation. Compliance features also provide assurance to stakeholders, including investors, regulators, and customers, fostering trust and credibility.

8. Integration with Other Systems

FMS integrates seamlessly with other business systems, such as ERP, CRM, and HRM software, ensuring data consistency and facilitating cross-functional collaboration.

This integration streamlines data exchange and eliminates silos, enabling a more holistic view of the business. Additionally, the scalability of FMS allows businesses to adapt to changing needs and scale their financial operations as they grow.

If you're looking for ways to enhance your business you must visit Sunbase!

Pros and Cons of Using Financial Management Software

Pros:

There are many benefits of using financial management software for your business.

1. Keeping Track

Perhaps the most obvious benefit is that it can help you to keep track of your finances on a single platform and budget more effectively. This can save you a lot of time and hassle in the long run, as well as help you avoid any nasty surprises further down the line.

2. Organize Finances

Another big plus point is that financial management software can help you to become more organized and efficient in your day-to-day operations. This in turn can lead to increased productivity levels and ultimately, increased profits.

3. Better Understanding

Not only that but using such software can also give you a better understanding of your business's financial situation and how you have been spending money, which can be invaluable when it comes to making strategic decisions about its future.

So, if you're looking for a way to streamline your business's financial management, then investing in a good quality ERP system could be the answer. It may require a bit of an upfront investment, but it's more than likely to pay off in the long run.

Cons:

Well, Of course, as with anything, there are also some potential drawbacks to using financial management software or an ERP solution.

1. Complex

One such drawback is that it can sometimes be quite complex and confusing to use, particularly if you're not particularly tech-savvy. This can lead to frustration and ultimately cause you to give up on using the software altogether.

2. Not Viable for everything

Another thing to bear in mind is that financial management solutions are no one-size-fits-all solutions. What works well for one set of financial data may not be so suitable for another set of financial data, so it's important to do your research and choose a program that's right for your business processes.

3. Expensive

Finally, financial management software can be expensive, both in terms of the initial purchase price and any ongoing subscription fees. If you're on a tight budget, financial software may not be the best option for you.

While ERP software has its drawbacks, it can also be a helpful tool if used correctly. Do your research to make sure you choose the "modern financial management software" that is right for you and your business processes.

How to Use Financial Management Software to Manage Your Finances?

Financial management software can help make it easier by giving you a clear picture of your spending and income.

There are many different financial and business management software programs available. Some are free, while others cost money. Before you choose a program, make sure it will work with your computer and that it has the features you need.

Once you have chosen a financial management software program, set up an account, enter your income and expenses, and record your business transactions. The program will then give you a clear picture of your finances and it also helps companies track spend. You can use this information to make changes in your business.

If you're looking for a financial management system for your business, check out Sunbase and book a free demo to see for yourself how Sunbase will improve your business operations and finances!

Best Financial Management Software

If you're a solar company or any company for that matter then you might already know how important it is to keep track of your finances if you have read so far.

That's why we've put together a list of the best financial management software for solar companies. With these tools, and their advanced functionality you'll be able to enhance your business functions and in turn, improve your financial performance.

Sunbase

The first tool on our list is Sunbase's Financial Management Software. This software offers a variety of features that will help you with your business planning by automating many core accounting processes and financial transactions.

With Sunbase, you'll be able to track your business data, income, and expenses, create a general ledger, and financial reports, create quotes and invoices, and much more. If you're looking for a comprehensive accounting system or the most promising financial management solution for your company, then Sunbase is the way to go.

Xero

The second tool on our list is Xero. Xero is cloud-based accounting software that offers a variety of features for businesses of all sizes and has one of the top financial management systems it provides accurate financial statements as the whole accounting system is automated.

With Xero, you'll be able to track your income and expenses (expense management) and create a general ledger, invoices, estimates, and more with business intelligence. Xero is a great option for a sap business and offers comprehensive financial management features without being too complex.

FreshBooks

The third tool on our list is FreshBooks. FreshBooks is another cloud-based accounting software that offers similar features to Xero. With FreshBooks, finance professionals can track your fixed assets, income, and expenses, create invoices and estimates, automate consolidation, and ease all your financial operations.

QuickBooks

The fourth tool on our list is QuickBooks. QuickBooks is also a cloud-based accounting software from Intuit that offers similar features to Xero and FreshBooks.

With QuickBooks Online, you'll be able to track your income and expenses, create invoices and estimates, cash management, and maintain other core accounting processes of bank accounts. QuickBooks Online is a great option for solar companies because it's easy to use and offers a variety of features that will help you track your finances.

Wave Accounting

The fifth tool on our list is Wave Accounting. Wave Accounting is free, cloud-based accounting software that offers a variety of features for small businesses. With Wave Accounting, you'll be able to track your income and expenses and create invoices and estimates using budgeting tools.

Additionally, it also helps in asset management, investment tracking, supply chain management, inventory management, project management, expense management, and a lot of other financial operations.

Wave Accounting is a great option for smaller companies because it's free to use and offers a decent variety of features that will help you better manage your finances.

How to Get the most out of Financial Management Software

If you're looking to get the most out of your financial management software, here are a few tips to keep in mind:

1. Choose the right Program

Make sure you choose a program that is right for you and your needs. There is no one best business management solution or best financial management system.

However, there are a few popular financial management systems you can choose from, so do your research to find the best option for you.

2. Regular Use

Use the software regularly to increase familiarity with the financial management modules. The more you use it, the more familiar you will become with its features and capabilities. This will help you get the most out of it and probably even utilize it for risk management.

3. Reach out for any help

If you run into any problems or difficulties in your financial processes or don't understand how the financial management systems work, don't hesitate to reach out to customer support for help. They can usually offer valuable insights and advice instead of your ERP software.

4. Spend Wisely

Be sure to stay within your budget when choosing a financial management system. It can be expensive, both in terms of the initial purchase price and any ongoing subscription fees.

But by following these simple tips, you can maximize your chances of success with a financial management system -software.

Conclusion

When it comes to choosing financial management software, there are a few key factors you need to consider. Cost is always a major concern, but you also need to make sure the financial software is easy to use and has all the features you need. With so many options on the market, it can be tough to know where to start.

But by keeping the things we discussed in the blog so far in mind, you can narrow down your options and find the best financial management software for your needs. And with the right software in place, you can take your business to the next level.

So don't wait any longer - start shopping around for the perfect financial management solutions today. Your business and the finance teams will thank you for it!

About Sunbase

Sunbase helps solar companies succeed through a suite of Solar CRM tools like Solar Lead Management Software, Solar Proposal Software, etc.! To book your free demo or an appointment, contact us here!

I agree to receive marketing messaging from Sunbase at the phone number provided above. I understand data rates will apply, and can reply STOP to OPT OUT.