October 9, 2024

Roofing Software

A roofing company secures its biggest project yet - a massive commercial complex that requires careful planning, strict deadlines, and coordination. The finance team is thrilled about the deal and anticipates substantial revenue.

However, as soon as the project gets underway, inefficiencies such as missed deadlines, rising material costs, and scheduling issues start to surface. Suddenly, profit margins start declining, and the once-seen as a profitable opportunity looks like a costly burden.

Large roofing projects often encounter this scenario, and the solution is to use the appropriate roofing software to transform chaos into clarity. Finance teams calculate the ROI of roofing software to ensure smooth project execution, profitability, and long-term success, not just based on numbers.

So, how can finance teams evaluate the value of this investment? Let’s dive in.

Key Takeaways

- Roofing software provides finance teams with real-time financial data, allowing them to make better choices and maximize ROI.

- It increases total project efficiency and minimizes unnecessary costs by streamlining operations and keeping track of workers, materials, and project timeframes.

- It provides long-term project profitability insights that guarantee sustainable growth and assist companies in making the most out of their future investments.

- Teams can effortlessly record, analyze, and share data with stakeholders with tools that can be easily customized, guaranteeing a clear return on investment for large roofing projects.

- To improve project management, limit costs, and maintain your competitive edge in the roofing industry, use roofing software.

Why is Roofing Software important for large-scale projects?

Roofing contractors who use software for managing have an advantage over those who continue to use outdated systems. Large-scale projects require roofing software as it eliminates costly errors, increases efficiency, and streamlines operations.

Investing in the right tools can assist roofing companies in creating an outstanding first impression with leads, executing large projects effectively, and positioning themselves for potential achievement with clients.

Roofing software facilitates project management, field workers coordination, and process automation, including scheduling, proposal, and payments all of which are a must to ensure a smooth project execution.

Let's take a look at some key statistics from WebFX:

- Commercial roofing services, including building and renovation, are accounted for $10.56 billion of the market share in 2022.

- The projected value of the worldwide roofing market in 2023 is $82.2 billion. Experts predict that between 2023 and 2033, the market will expand at a compound annual growth rate (CAGR) of 5.5%.

A roofing business working on massive commercial roofing projects has plenty of options in this thriving sector. Considering this, roofers need to make the most of their offerings and make good use of all the resources at their disposal to provide the best possible service to their clients.

Discover how Roofing Management Software can help with tracking tasks and managing projects.

How can finance teams assess Roofing Software Effectiveness?

Roofing software is intended to simplify complex activities such as roofing sales, project management, and job tracking; but, how do you evaluate its impact? Let's explore the key features:

1. Project Management Tools

Is your roofing software keeping pace with your projects?

Large-scale commercial roofing projects require several teams, materials, and deadlines. Finance teams must evaluate if the software permits roofing contractors to easily schedule appointments, track job details, and receive real-time updates from the job site.

Reducing avoidable fees and delays with efficient project management tools will keep roofing jobs profitable.

2. Financial Management Capabilities

Your financial health starts with your roofing software. Project finance management is equally valuable as physical labor.

Roofing software should speed up payment processing, invoicing, and budgeting, while finance teams should analyze its capacity to track labor costs, material expenses, and profit margins for every roofing work.

In addition to lowering manual errors, a system that provides smooth financial administration also helps finance teams maintain project budgets and enhances the roofing sales process as a whole.

3. Reporting and Analytics

From data to dollars, you are measuring software's analytical impact.

Finance teams should look for software that allows them to create customized dashboards and access accurate information on key metrics like roof measurements, labor efficiency, and project viability.

This information helps in resource allocation optimization, identifying bottlenecks in the workflow, and forecasting a future roofing job.

4. Customer Relationship Management

Happy customers mean a healthy bottom line.

Effective CRM tools included in the program enable teams to manage client interactions, follow up on prospects, and keep a complete record of previous roofing works.

Strong client relationships have a major influence on roofing contractors' ability to get repeat business, thus it's fundamental that the software facilitates prompt follow-ups and effective communication to increase customer retention.

Here's the Top Roofing CRM to Increase Efficiency in 2024.

5. Integration with Other Systems

Is your roofing software connected to your entire business ecosystem? No software operates completely independently, the best roofing software needs to work in harmony with the roofing company's current toolbox.

Integrating technologies to assist with roof measurements and plans or accounting platforms for improved accounting data is necessary for effectively managing the entire company.

Teams in charge of finance should evaluate how effectively the software works with the systems they now use to ensure that information moves seamlessly from sales to project management to financials.

Here are the Best Roofing Software Tools to Streamline Your Business in 2024.

What is ROI and how do you calculate it?

ROI, or return on investment, is a statistic that assesses how profitable or efficient an investment is. The computation involves dividing the investment's net return by its cost.

Usually, ROI is expressed as a percentage, to facilitate comparison.

The formula for calculating ROI is:

ROI = (Net Profit / Cost of Investment) x 100

Where:

Net Profit = Total Revenue - Total Cost

Cost of Investment = Initial amount invested

For example, if you invested $1,000 in roofing software and made $10,000, your return on investment would be 90%.

Why ROI analysis is crucial for finance teams when investing in technology?

When finance teams calculate return on investment (ROI), they look at how much the software speeds up the sales process for roofing contractors, improves project accuracy, and lowers human labor.

Finance teams can more effectively communicate the long-term advantages of software investment to stakeholders with the help of ROI research to support their arguments.

The software enhances job site coordination, customer communication, and commercial roofing project profitability, enabling finance teams to make informed decisions and align with long-term business objectives using data-driven insights.

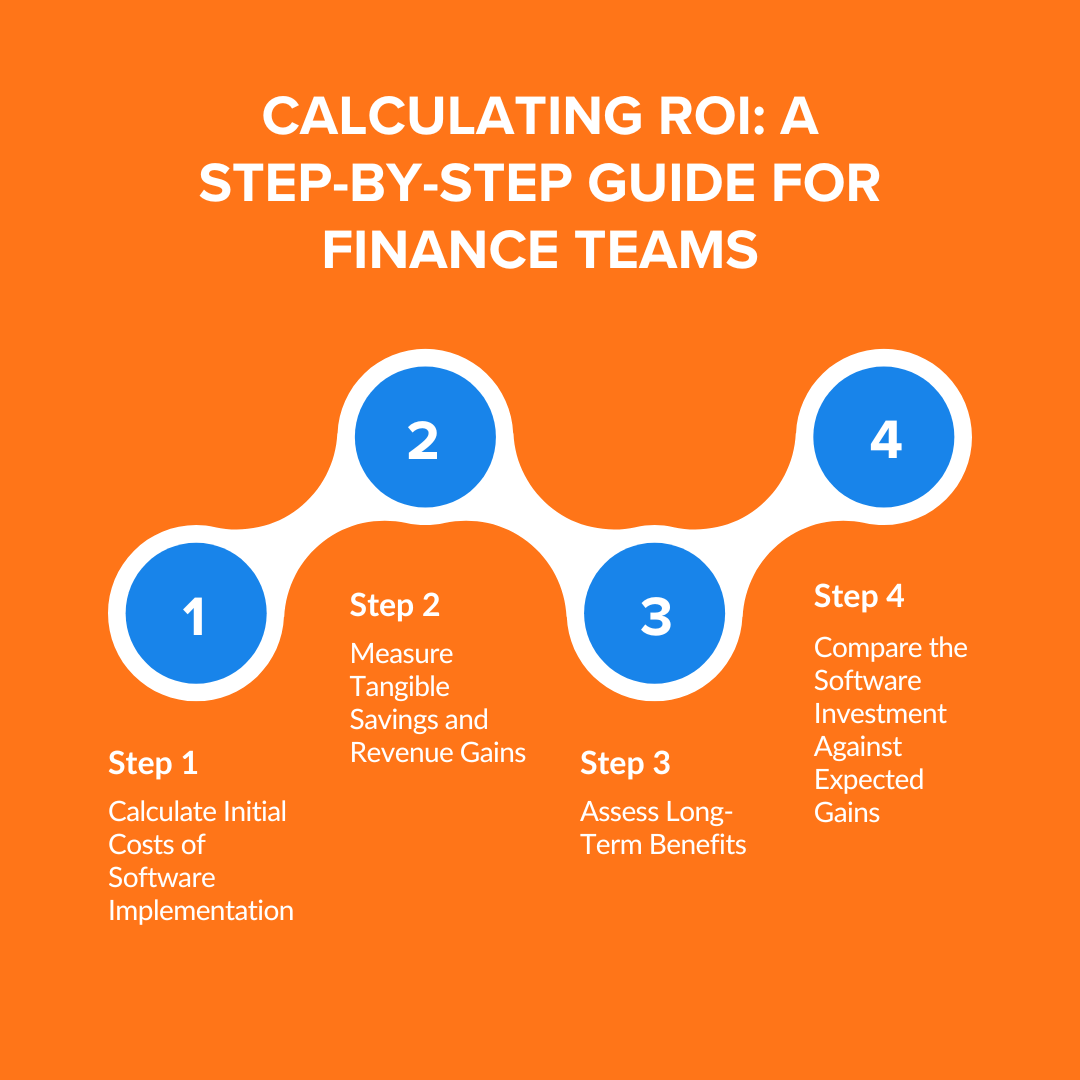

Calculating ROI: A Step-by-Step Guide for Finance Teams

Let's go:

Step 1: Calculate the Initial Costs of Software Implementation

Begin by calculating all upfront costs. This covers the purchase price, team member training expenses, and integration fees required to integrate the software with current systems easily and seamlessly.

Thorough cost analysis guarantees a strong foundation for ROI estimates.

Step 2: Measure Tangible Savings and Revenue Gains

Estimate the savings made possible by increased efficiency, for example, reduced labor hours and material waste.

Take into account the possible increase in revenue that could result from managing more projects or providing higher-quality services. This phase is a prerequisite for demonstrating the software's instant financial benefit.

Step 3: Assess Long-Term Benefits

Shift your focus towards the future and assess future benefits.

Enhancing project management skills and elevating consumer contentment are important advantages that can result in long-term company expansion.

These long-term benefits frequently result in increased retention of customers and fresh business prospects.

Step 4: Compare the Software Investment Against Expected Gains

Lastly, calculate the overall return on investment by comparing the total investment to the projected financial returns.

Finance teams can use this comparison to determine whether the program offers value that justifies the investment, in addition to covering its costs. A positive ROI suggests a worthwhile investment consistent with strategic business goals.

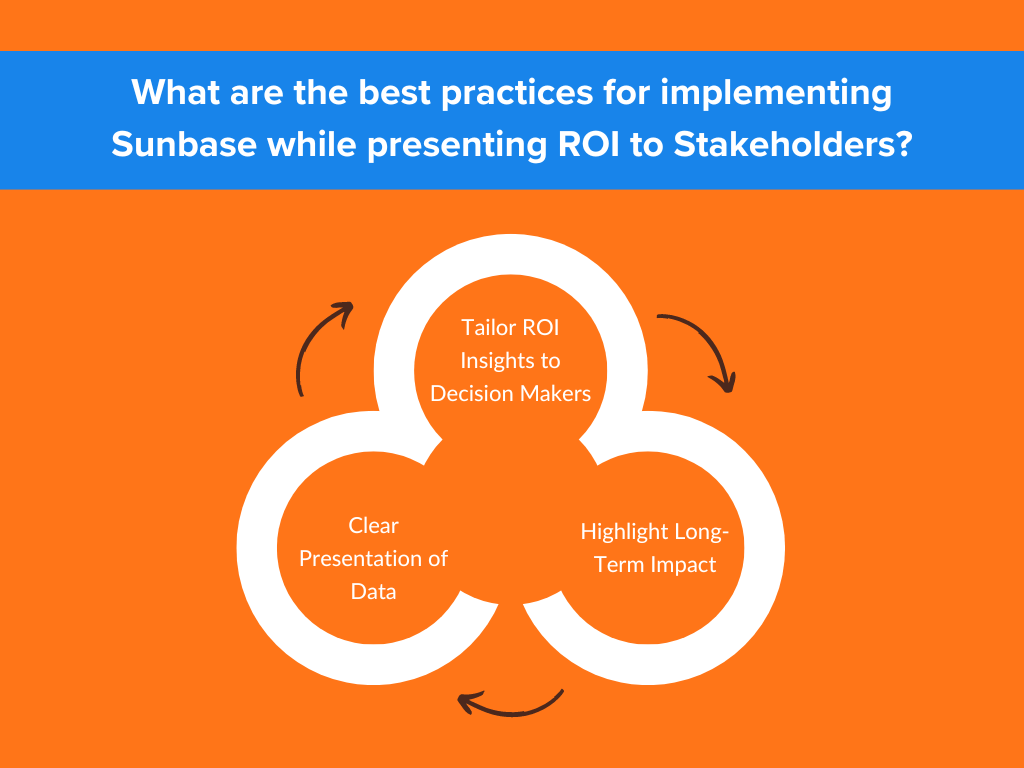

What are the best practices for implementing Sunbase while presenting ROI to Stakeholders?

Here’s how to do it right:

1. Clear Presentation of Data

The way you present facts can considerably influence stakeholder perception. Make the financial advantages of the roofing project visually appealing and understandable using graphs and charts.

You can increase transparency and make difficult information understandable by using simple graphics, which will boost stakeholder confidence.

2. Tailor ROI Insights to Decision Makers

The secret to good communication is to figure out the various interests of stakeholders.

Whether their priorities are cost reduction, sustainability, or meeting project deadlines, tailor your ROI insights to fit their needs.

You may establish your project as the benchmark in the cutthroat roofing industry by immediately addressing these issues and making sure that all important information reaches all stakeholders.

3. Highlight Long-Term Impact

Securing stakeholder trust requires highlighting the long-term benefits in addition to the immediate profits.

Demonstrate how the project will improve the financial performance of roofing businesses in the long run, increase the value of their properties, and lower their maintenance expenses.

In a nutshell

In large-scale roofing projects, financial teams have a major role in ensuring that every dollar spent yields measurable outcomes.

As Robert Arnott advised, "In investing, what is comfortable is rarely profitable."

He contradicts the concept that safe and familiar investment decisions result in high returns and that the path to financial achievement frequently necessitates taking calculated risks.

Accepting this kind of innovation keeps companies competitive while also improving project results. Finance teams must carefully consider their investments and make the most of technology to fuel the roofing industry's future expansion and success.

About Sunbase

Maximize Your Investment!

Sunbase: Your financial partner for large-scale roofing projects.

FAQ's

Q1. What are common ROI pitfalls to avoid?

Ans- In the roofing game, inaccurate cost calculation, neglecting long-term benefits, and inadequate training are the major factors to avoid.

Q2. Can Sunbase Roofing Software improve the accuracy of project cost estimation?

Ans- Yes, Sunbase Roofing Software improves cost estimation accuracy by including extensive budget planning and tracking capabilities. Through the integration of data from multiple project stages, this roofing app reduces financial risk by enabling finance teams to spot inaccuracies early and modify budgets accordingly.

Q3. What specific metrics can finance teams use to measure the ROI of Sunbase Roofing Software?

Ans- Financial teams can evaluate the software's return on investment by monitoring project completion time, cost overruns, customer satisfaction, and revenue generated.

I agree to receive marketing messaging from Sunbase at the phone number provided above. I understand data rates will apply, and can reply STOP to OPT OUT.